Industry economist projects that 600,000 active drivers could be eliminated from trucking

The Calm Before the Storm: Freight’s Current Reality

The freight industry is experiencing what experts describe as one of the most interesting times ever in freight—though unfortunately, not in a positive way for most participants. Motor carriers and freight brokers across the spectrum are feeling significant pain from weak freight volumes and a rapidly changing operating climate. What we’re witnessing appears to be the calm before a significant storm, with indicators pointing toward what could become the largest capacity washout in trucking history.

With the risk of the market eliminating 600,000 active drivers, the largest capacity purge in history may be coming, bringing COVID-like spot rates. The difference this time is that there won’t be a flood of immigrants created by Biden’s open borders, which offered an endless supply of truck drivers. The capacity relief valve for shippers and brokers is forever shut, meaning carriers will have to pay up in terms of higher pay and bonuses for truck drivers. Capacity will also be much harder to find.

Factors Contributing to the Freight Market Decline

Freight volumes have dramatically decreased, with year-over-year figures showing a staggering 18% decline. This precipitous drop has created severe challenges for motor carriers struggling to find loads and for freight brokers operating with minimal volume to sustain their businesses.

The situation is particularly dire for brokers with spot market exposure, as the scarcity of freight leaves little room for profitability. Even the contract market presents significant challenges, as many brokers have locked in business at unsustainably low rates while competing against asset-based carriers. This has created a system where many participants are underwater, and it is not sustainable.

Small motor carriers face additional pressures, especially those that have hired non-domiciled CDL drivers who may now be unable to meet regulatory requirements such as the English Language Proficiency (ELP) mandate.

Fraud continues to accelerate, as fraudsters have figured out how to reverse engineer Highway’s and RMIS’ systems. This has caused a sharp increase in fraud, and brokers—afraid of getting stung—have learned the hard way and are no longer overriding even the most benign flags. This can sting even the most legitimate carriers if they receive false positives in compliance verification systems. Any carrier that gets flagged by these fraud mitigation systems can find themselves locked out of participating in almost any brokerage freight—a death sentence for carriers struggling to survive.

Capacity Purge and Regulatory Changes

The anticipated “great purge” of capacity stems from several converging factors, most notably recent changes in U.S. immigration policy and enforcement. According to research from J.B. Hunt, these policy changes—particularly regarding non-domiciled Commercial Driver’s Licenses (CDLs) and English Language Proficiency requirements—are expected to remove between 5% to 12% of CDL holders (214,000–437,000 drivers) from the U.S. supply over the next two to three years.

On September 26, 2025, the Federal Motor Carrier Safety Administration (FMCSA) issued an emergency ruling that immediately restricts the issuance and renewal of non-domiciled CDLs. The FMCSA estimates that 97% of the current 200,000 non-domiciled CDL holders will be unable to satisfy the new requirements, leading to their likely exit from the industry over the next one to three years. This represents approximately 5% of all registered CDLs in the United States.

Concurrently, stricter enforcement of English Language Proficiency regulations has resulted in over 23,000 violations, with more than 5,000 resulting in out-of-service orders. According to industry analyst Avery Vise, this enforcement alone could remove approximately 20,000 drivers annually from the workforce.

When accounting for the overlap between drivers affected by non-domiciled CDL restrictions and ELP enforcement, plus undocumented drivers and restrictions on new hires, the total at-risk population could exceed 600,000 drivers—representing about 17% of active drivers, according to transport economist Noël Perry.

Carriers that rely upon immigrant labor or carriers that don’t qualify under the new rules will likely go out of business.

Economic Implications of the Capacity Purge

The combination of regulatory changes and prolonged freight recession conditions is creating an environment ripe for significant market disruption. Industry experts anticipate numerous bankruptcies among both carriers and brokers in the coming months as financial pressures mount.

The market rationalization expected to follow this capacity purge will likely favor the largest asset carriers, who have the resources to weather the storm and adapt to the changing regulatory landscape. This represents a significant shift from the recent market dynamic where the availability of truck drivers supplied through immigration enabled many small operators to expand their fleets without adhering to traditional operational requirements.

As the market corrects, motor carriers will need to offer improved driver pay and incentives to attract qualified drivers from a diminishing pool of eligible candidates. This shift toward a more traditional supply-demand balance may ultimately lead to improved profitability for surviving carriers, though the transition period will undoubtedly be challenging.

Navigating the Road Ahead: Freight’s Path to Recovery

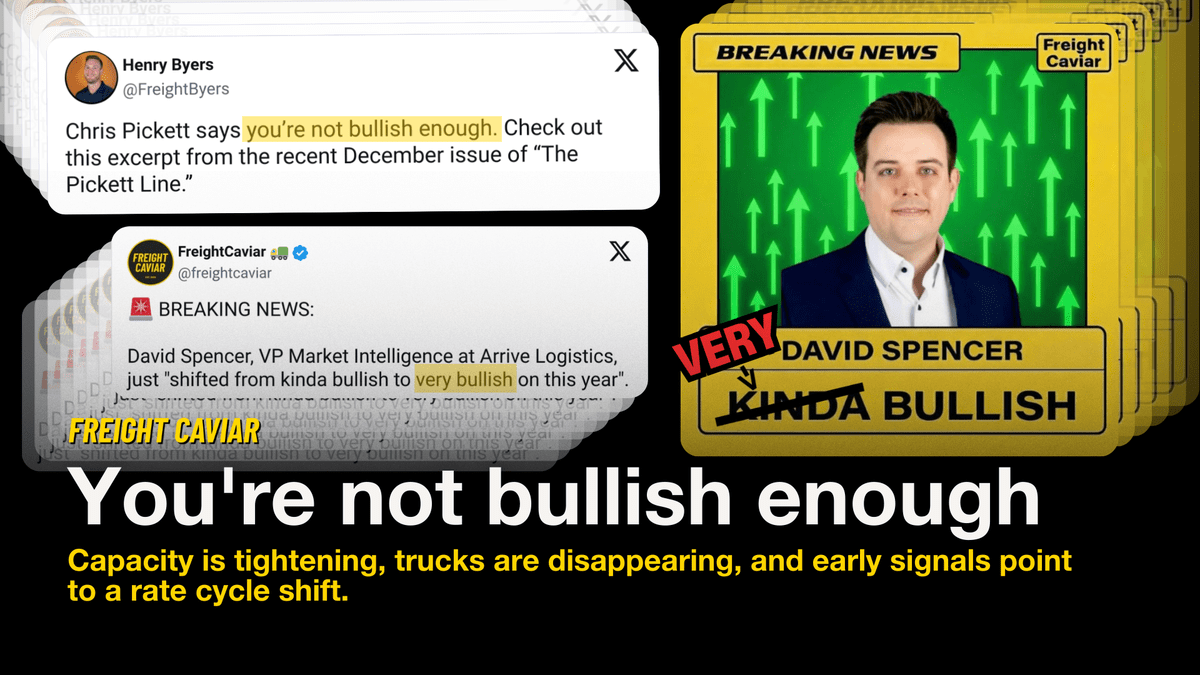

The freight industry stands at the precipice of a transformative period. The anticipated capacity washout, driven by regulatory changes and sustained market weakness, will likely lead to accelerated spot rates and stabilizing contract rates as the market rebalances.

While the timeline for this transition remains uncertain, the eventual outcome points toward a market that operates according to more traditional supply and demand principles. For shippers, this means preparing for potential rate volatility and capacity constraints. For carriers, especially larger ones that can navigate the regulatory landscape, it represents an opportunity to return to more sustainable operating conditions after an extended period of market disruption.

If volumes pop—which doesn’t exist right now—hold on to your hat. It’s going to be one of the best freight markets that carriers have seen in some time. While the road to that point will be challenging, the industry may ultimately emerge stronger and more stable once this unprecedented capacity purge has run its course.

The post Largest capacity purge in history coming appeared first on FreightWaves.

Fuente: https://www.freightwaves.com/news/largest-capacity-purge-in-history-coming